If you are a new to investing and want to learn what a balance sheet is, you’ve come to the right place. This article is intended to teach the very basics of the balance sheet for beginners.

What is a Balance Sheet?

Here you’ll learn the basics of the balance sheet and how to use its information to make smarter investing decisions.

A balance sheet is a financial document for a company that details its assets, liabilities, and shareholder’s equity.

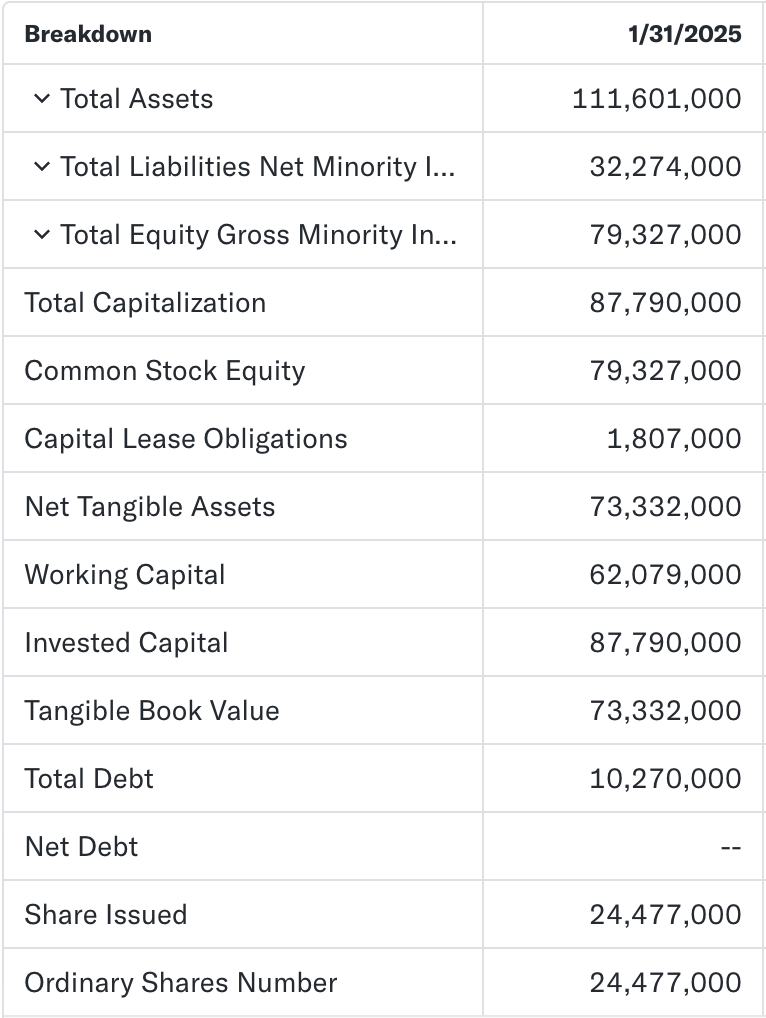

This is NVIDIA’s balance sheet as of January 31, 2025 and you can read at it here.

To know what assets, liabilities, and shareholder’s equity are, here are those definition.

- Asset: An item that is owned by the company used to generate income.

- Cash, vehicles, investments, property, machinery, inventory, patents, and more

- Liability: A debt, or a financial obligation, that the company owes.

- Debt, money borrowed, mortgage, wages, bills, and more

- Shareholder’s Equity: The net worth of a company. The shareholder’s equity is determined by subtracting the dollar amount of liabilities from the dollar amount of assets.

There is actually a simple equation to express all three of these terms together, which is:

Shareholder’s Equity = Assets – Liability

Lets take a simple house as a metaphor for a balance sheet.

The assets of the house would include the structure itself, and everything inside of it.

The homeowners have a mortgage and credit cards they use. Those would be the liabilities.

Now the homeowners can find out what’s left over in dollar amount by doing the math and subtracting their debt from everything they own thats associated with the house. That would be their net work, or shareholder’s equity.

Why this is important to a balance sheet beginner?

You might assume that a large corporation is doing well simply because of how large it is. That is not always the case. It’s important to understand that a company always has the risk of not making enough money and going out of business.

What happens to your money if you invest in a company that goes out of business? Most, if not all, of that money is gone.

The risk of going out of business is of course applicable to every company running today. Anything could happen, technically. However, the risk of a company going under with more assets than liabilities is a lot less likely than a company with more debt than cash.

- More assets than liabilities -> Strong, more flexibility, and much more investor confidence

- More liabilities than assets -> Less stable, more risk, harder to recover during market turmoil, and ultimately less investor confidence.

Why Do Companies Have Balance Sheets?

Any company’s stock that you see being traded publicly, like NVIDIA, must comply with the Security and Exchange Commission. One of those requirements is to provide the public with its balance sheet.

Companies that are publicly traded are legally obliged to generate two kinds of balance sheets periodic balance sheets. In this balance sheet for beginners guide, I won’t harp on them too much but it’s good to know at least what they are.

Annual Report (Form 10-K)

Its a prepared financial document which includes the balance sheet. Its reported once a year.

Quarterly Report (Form 10-Q)

A prepared financial document which includes the balance sheet. Its reported every quarter, or three months.

Time to Analyze

A company that is traded will typically have more than one available balance sheet.

One of the most popular and convenient ways to find a company’s balance sheet is through Yahoo Finance. Its easy to find, read, and compare a balance sheet for beginners. If you’re unfamiliar, go to their homepage and search under the Markets tab. There, you can find information on pretty much all tradable instruments including crypto, currencies, options, and much more.

Find a stock you wish to analyze. You can choose any stock you wish. I’m going to choose NVIDIA like I have been for this entire article.

Great, you’ve made it to a stock’s page.

You’ll see on the left a list that looks something like this. click on Financials and there you’ll be prompted to the company’s public financial documents.

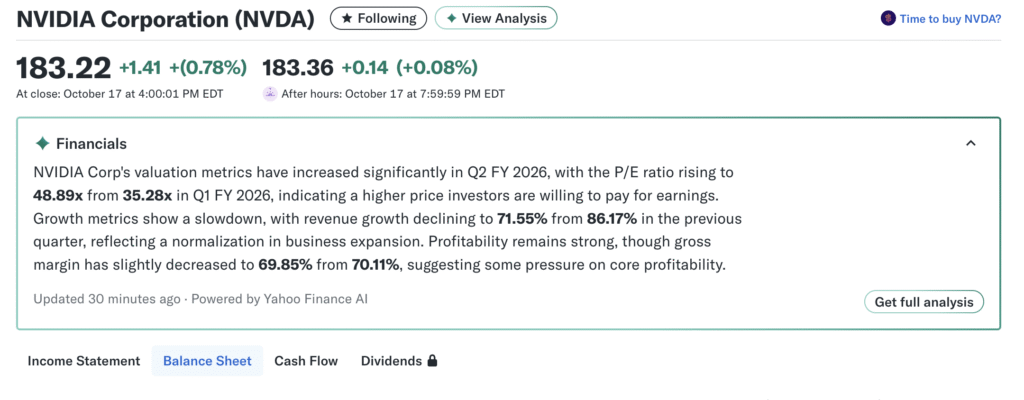

Im providing another picture here to show once you’ve hit the Financials tab, you’ll see some options that say “Income Statement,” “Balance Sheet,” “Cash Flow.” Hit “Balance Sheet.”

Looking at multiple balance sheets for a company doesn’t just provide you with a snapshot of its health. It gives a story of the company’s financial strength through the years. Here, NVIDIA’s total assets have grown very strong since 2022. While its liabilities have also grown, that does not indicate its doing bad financially. In fact, if you look at NVIDIA’s total equity, its steadily increased since 2023. That shows that while its liabilities have increased, its assets have increased at a stronger rate.

This shows that the company is doing well financially, and indicates that investing into NVIDIA may be a good decision.

However, looking at just a company’s balance sheet is not enough for investing. It only gives one piece of the puzzle in determining how financially strong a company is.

To know more about a company, we’ll have to look at other financial documents. And I’ll discuss those at another time.

To learn more about investing, click here to read more!